The occupancy type of a property—whether it’s a primary residence, second home, or investment property—has a significant effect on the mortgage rate and loan terms offered by lenders. Here’s a breakdown of how each occupancy type impacts mortgage rates:

1. Primary Residence

- Description: A primary residence is where the borrower lives most of the time. Lenders consider these the lowest-risk type of property because they expect borrowers to prioritize payments on a home they live in.

- Impact on Mortgage Rate: Primary residences generally qualify for the lowest mortgage rates among occupancy types. The lower risk involved in lending for primary residences means lenders can offer more favorable rates.

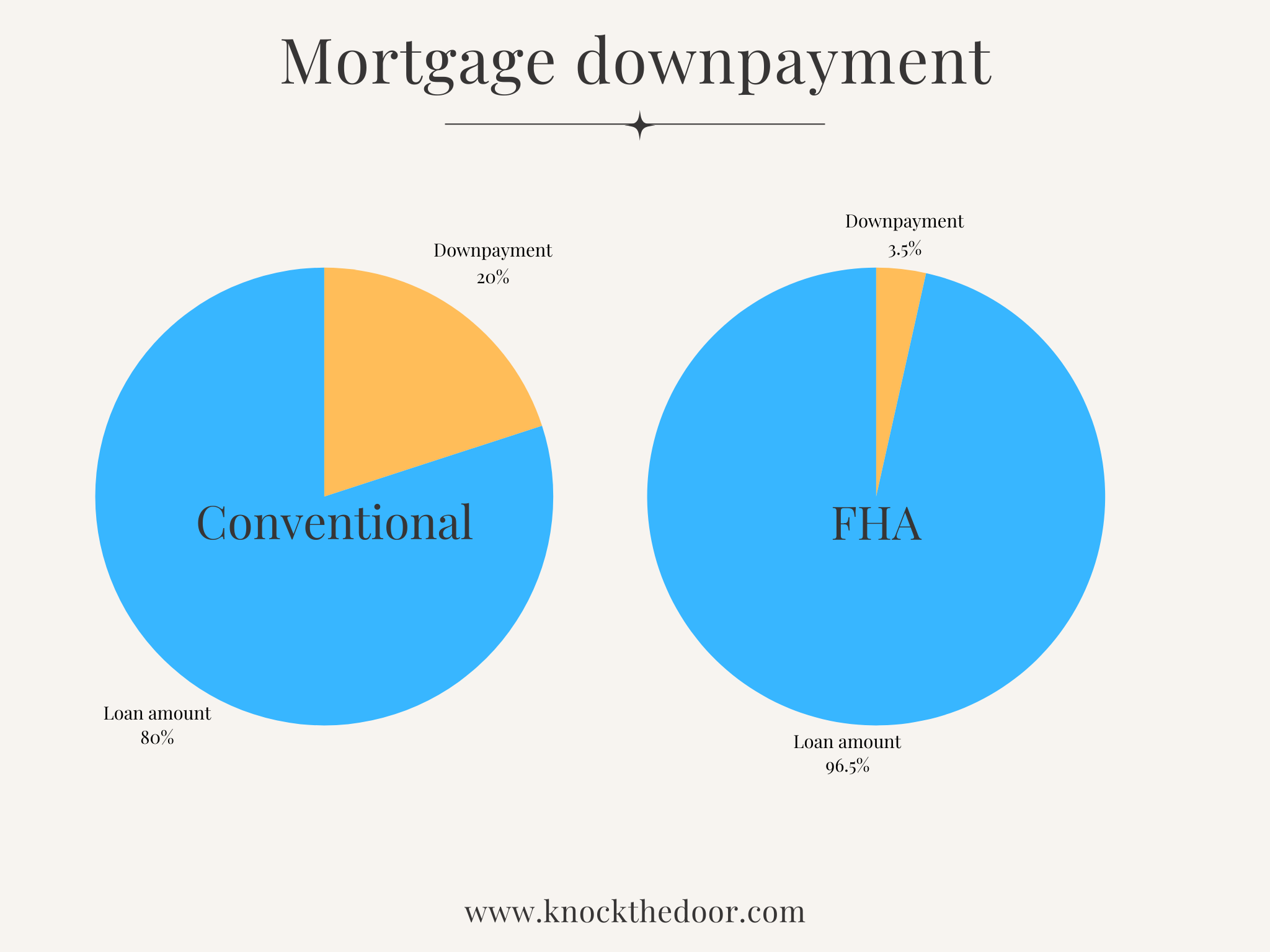

- Typical Down Payment and Terms: Down payments can start as low as 3% (for conventional loans) and 0% (for VA loans), and borrowers have access to various loan types, including FHA, VA, and USDA loans, with flexible terms and lower interest rates.

2. Second Home (Vacation Home)

- Description: A second home is used part-time by the owner and is typically located in a different area than the primary residence, like a vacation destination.

- Impact on Mortgage Rate: Mortgage rates for second homes are often slightly higher than those for primary residences, as lenders see them as higher risk. The increased risk arises from the possibility that borrowers may prioritize their primary residence payments over a second home in case of financial difficulty.

- Typical Down Payment and Terms: Lenders typically require at least a 10% down payment on a second home. Some lenders also require borrowers to have higher credit scores and cash reserves for second homes, which impacts the loan terms.

3. Investment Property (Rental Property)

- Description: Investment properties are purchased with the intent to generate rental income or resell for profit rather than for the owner to live in. These include single-family homes, multi-unit properties, and condos rented to tenants.

- Impact on Mortgage Rate: Investment properties come with the highest mortgage rates among occupancy types, as lenders consider them the riskiest. Borrowers may face rental vacancies, tenant issues, and fluctuations in rental income, making investment properties more likely to default.

- Typical Down Payment and Terms: Investment properties usually require a down payment of 15%–25%, and higher interest rates are typical. Some lenders may also require significant cash reserves and a solid credit score. Loan terms can also be more restrictive, and mortgage insurance is generally not available for investment property loans.

Summary Table

Key Takeaways

- Risk and Rate Correlation: Lenders offer the best rates for primary residences due to lower risk, while second homes and investment properties incur higher rates due to greater risk factors.

- Down Payment Requirements: Down payments increase with risk level. Primary residences require the lowest down payments, while investment properties need the highest, often at least 15%-25%.

- Credit Score and Reserve Requirements: Investment and second homes may require higher credit scores and cash reserves than primary residences to offset the added risk.

- Mortgage Insurance Options: Mortgage insurance is usually available only for primary residences and some second homes with low down payments. Investment properties generally don’t have mortgage insurance options, so borrowers typically need 20%-25% down.

Conclusion

Choosing the occupancy type for your property will significantly impact your mortgage rate, required down payment, and other loan terms. Primary residences are the most affordable in terms of rates and down payment, while investment properties come with higher costs and stricter requirements due to the risk associated with generating income through rental tenants.

Disclaimer/Disclosures:

The information provided on this website is for general informational and educational purposes only and must NOT be construed as legal, financial, investment or any other expert advice. Real estate investing involves many risks; any content, presentations, pages, blog posts must not be construed as expert advise, results vary based on many many factors and variables.

We make no representations or warranties about the accuracy or reliability of the information provided.

Always consult a licensed expert, real estate professional and/or financial advisor about your real estate and investment decisions.

View our Disclosures, Privacy Policy and Terms & Conditions.