The condition of a property significantly impacts mortgage options, influencing factors such as loan eligibility, interest rates, and required down payments. Here’s how property condition affects mortgage options:

1. New Construction

- Description: Newly built homes or newly renovated properties that meet current building codes and standards.

- Impact on Mortgage Options:

- Mortgage Types: Most conventional lenders readily approve mortgages for new construction. FHA and VA loans can also be used if the property meets specific requirements.

- Inspection Requirements: Lenders may still require a home inspection to verify that everything is up to code, but new construction often faces fewer issues.

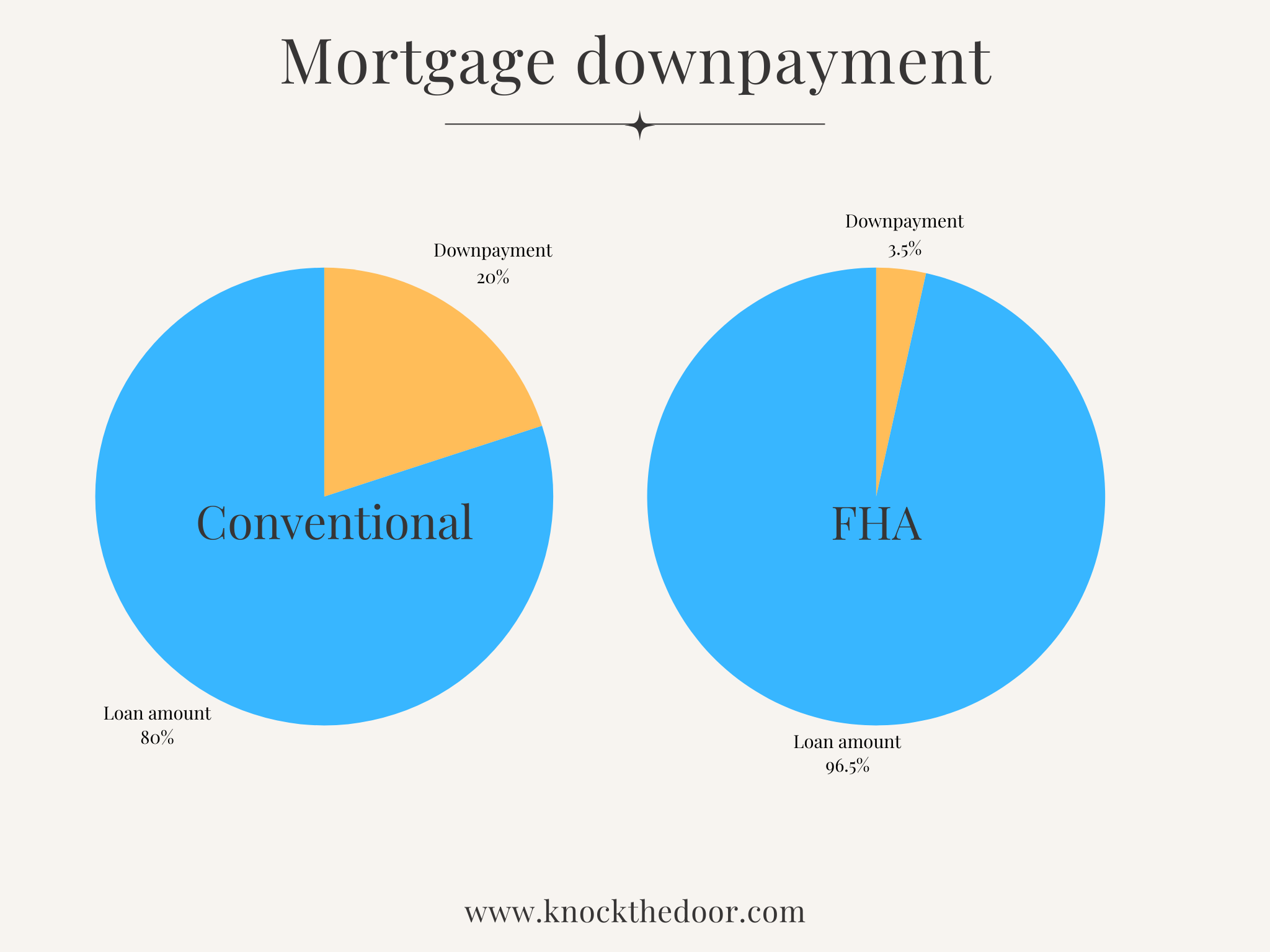

- Down Payment and Rates: Buyers can often secure favorable rates and low down payments, similar to existing primary residences. Some builders may offer incentives or rate buy-downs.

2. Well-Maintained Properties

- Description: Properties that have been regularly maintained, with no major repairs needed.

- Impact on Mortgage Options:

- Mortgage Types: Generally eligible for all mortgage types, including conventional, FHA, and VA loans.

- Inspection Requirements: Lenders may require a standard home inspection to confirm that the property is in good condition, but issues are typically minimal.

- Down Payment and Rates: Buyers can qualify for competitive rates and lower down payments, especially for primary residences.

3. Fixer-Uppers / Distressed Properties

- Description: Homes that require significant repairs or renovations, including structural issues, outdated systems, or cosmetic updates.

- Impact on Mortgage Options:

- Mortgage Types: Buyers may need to consider specialized loans, such as:

- FHA 203(k) Loans: These allow buyers to finance the purchase and renovation costs within one loan. The property must meet specific criteria.

- HomeStyle Renovation Loans: Offered by Fannie Mae, these allow financing for renovations as part of the mortgage.

- Inspection Requirements: More rigorous inspections are usually required, and lenders will want to know the extent of repairs needed before approving the loan.

- Down Payment and Rates: Down payments may be higher, and rates may vary depending on the lender’s risk assessment. Lenders may require a higher credit score due to the perceived risk of distressed properties.

- Mortgage Types: Buyers may need to consider specialized loans, such as:

4. Condemned Properties

- Description: Properties deemed uninhabitable or unsafe by local authorities, often due to significant structural issues or code violations.

- Impact on Mortgage Options:

- Mortgage Types: Traditional mortgage options are typically unavailable for condemned properties. Buyers may need to seek cash purchases or specialized hard money loans.

- Inspection Requirements: Extensive inspections will be necessary to determine the scope of repairs needed for the property to be deemed habitable again.

- Down Payment and Rates: Generally, buyers may face higher costs if financing is available. Most lenders will require a larger cash investment upfront due to the high-risk nature of these properties.

5. Investment Properties

- Description: Rental properties, which may vary in condition, from well-maintained to distressed.

- Impact on Mortgage Options:

- Mortgage Types: Investment properties can be financed with conventional loans, but options may be limited if the property is in poor condition.

- Inspection Requirements: Lenders will require thorough inspections to ensure the property can generate rental income and is safe for tenants.

- Down Payment and Rates: Investment properties generally require higher down payments (15%-25%) and face higher interest rates, especially if the property is distressed.

Summary Table

Key Takeaways

- Mortgage Types: The condition of the property determines which mortgage types are available. New and well-maintained properties qualify for standard loans, while fixer-uppers may require specialized loans.

- Inspection Requirements: Lenders require varying levels of inspections based on property condition. Distressed or condemned properties face stricter scrutiny to assess repair costs and livability.

- Down Payments and Rates: The more distressed the property, the higher the potential down payment and interest rates due to increased risk. Well-maintained properties generally allow for lower rates and down payments.

- Risk Assessment: Lenders conduct a risk assessment based on property condition, influencing loan eligibility and terms. Properties needing significant repairs or deemed uninhabitable will face higher barriers to financing.

Conclusion

The condition of a property plays a crucial role in determining the mortgage options available to buyers. New and well-maintained properties provide the most favorable terms, while distressed or condemned properties present significant challenges in securing financing. Understanding these factors can help buyers make informed decisions when purchasing a property.

Disclaimer/Disclosures:

The information provided on this website is for general informational and educational purposes only and must NOT be construed as legal, financial, investment or any other expert advice. Real estate investing involves many risks; any content, presentations, pages, blog posts must not be construed as expert advise, results vary based on many many factors and variables.

We make no representations or warranties about the accuracy or reliability of the information provided.

Always consult a licensed expert, real estate professional and/or financial advisor about your real estate and investment decisions.

View our Disclosures, Privacy Policy and Terms & Conditions.