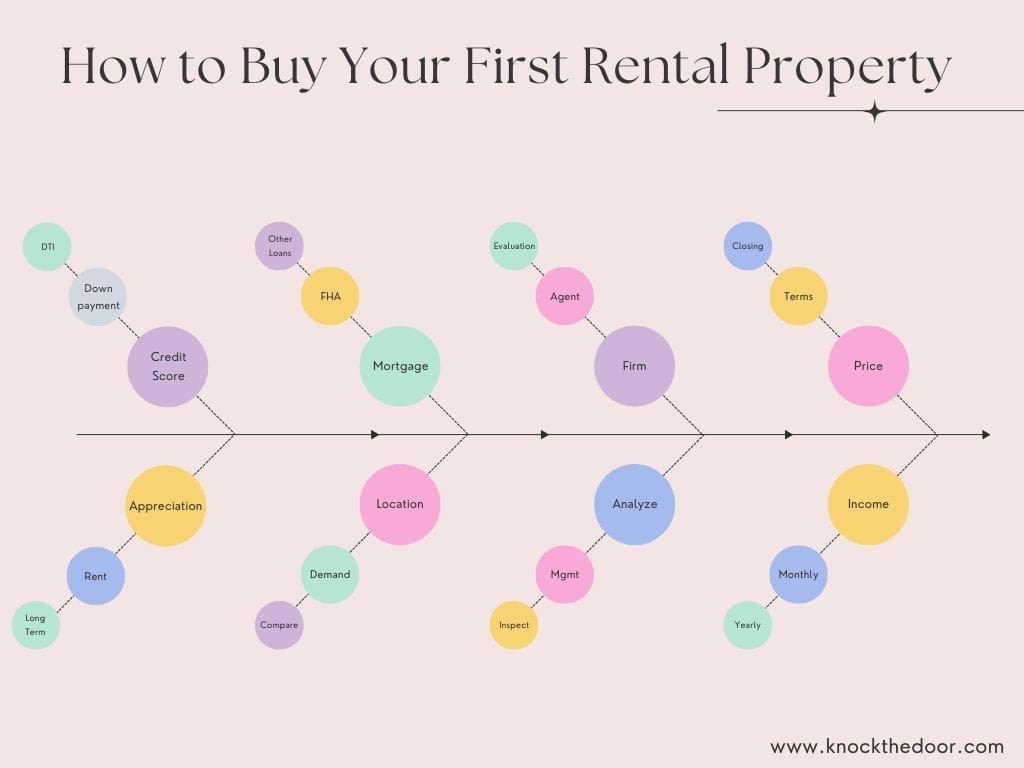

Buying your first rental property can be exciting with proper planning and execution. Step-by-step guide to help you through the process:

- Assess Your Financial Situation

- Set Your Investment Goals

- Research Markets

- Secure Financing

- Work With a Real Estate Firms or Agent

- Analyze Potential Properties

- Make an Offer

- Prepare for Tenants

- Maintain the Property

- Consider Long-term Plans

1. Assess Your Financial Situation

- Check your credit score: A higher credit score will likely secure you a lower mortgage rate.

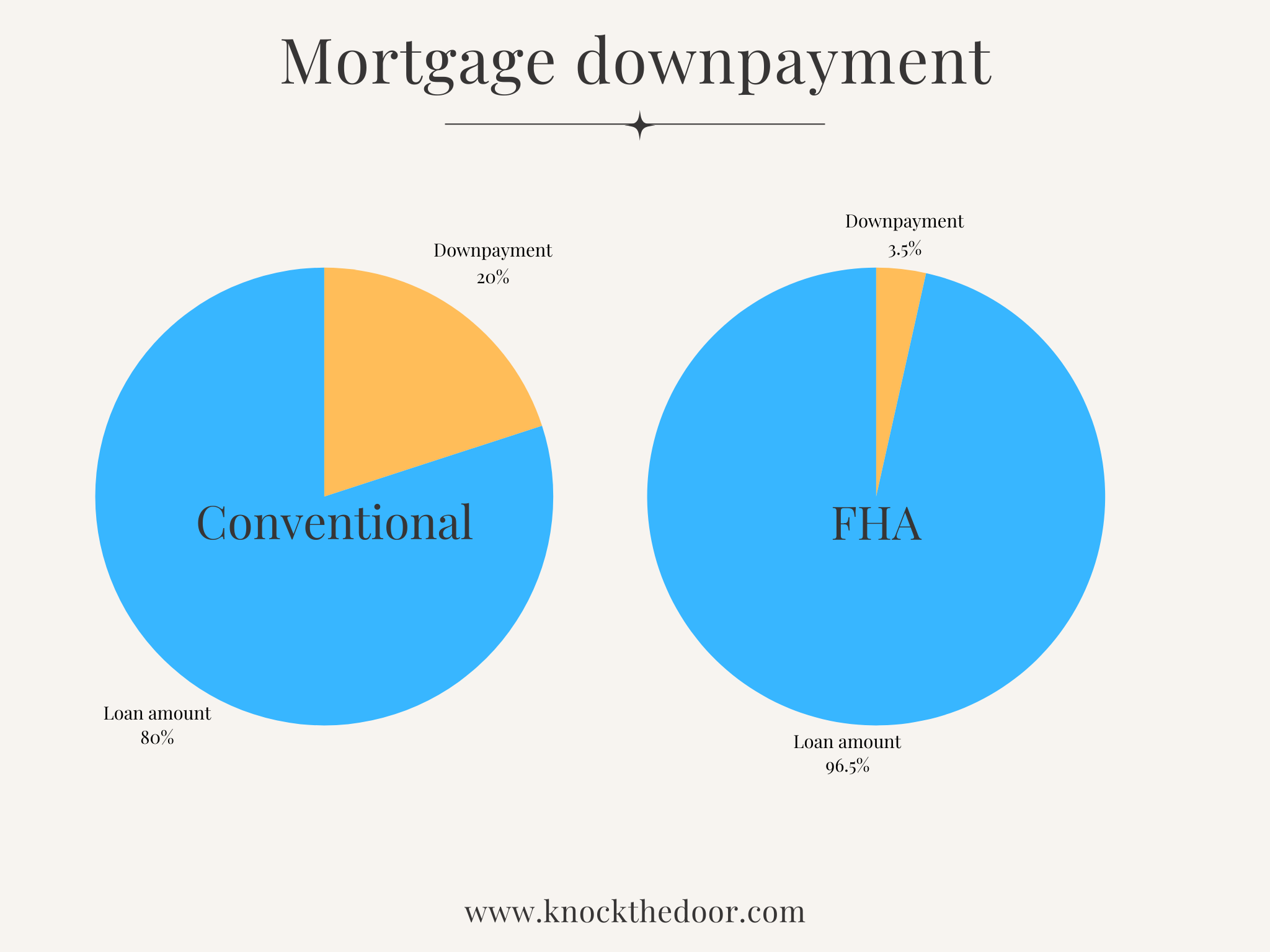

- Save for a down payment: Most lenders require 20% or more for investment properties, unlike primary residences which might allow for a smaller down payment.

- Emergency fund: You’ll need cash reserves to cover repairs, maintenance, or vacancies.

- Calculate debt-to-income ratio: Lenders will also look at your debt-to-income ratio (typically 43% or lower).

2. Set Your Investment Goals

- Cash flow: This is the money left over after you pay for all expenses, including mortgage, maintenance, and property management.

- Appreciation: The increase in property value over time can build long-term wealth.

- Long-term strategy: Decide if you want to buy-and-hold for rental income or look to flip properties in the future.

3. Research Markets

- Location is key: Look for areas with population growth, good job markets, and affordable property prices.

- Rental demand: Research whether there’s demand for rental properties in the area. College towns, suburban neighborhoods, or growing metro areas are often solid choices.

- Compare properties: Study rental prices in your chosen area. Ensure you can charge enough rent to cover your expenses and generate profit.

4. Secure Financing

- Traditional mortgage: This is often the go-to option for first-time buyers, especially if you have good credit and a sizable down payment.

- FHA loan: For those with lower credit scores, an FHA loan could help you purchase a multi-unit property (up to four units), allowing you to live in one unit and rent out the others.

- Hard money loans: Short-term loans, typically for those planning to flip properties or who cannot qualify for traditional financing. You have to be careful with lenders in this space to understand their reputation and terms.

- Private lenders or partnerships: You may partner with other investors or seek private lenders if traditional loans are challenging.

5. Work With a Real Estate Firms or Agent

- Find a firm who has rental income mode to offer: Look for firms like our firm KnockTheDoor.com who offer a win-win model and can help you find properties with good potential.

- Find an agent with investment experience: Look for agents who understand the rental market and can help you find properties with good potential.

- Evaluate properties: Consider properties that need minimal repairs or have long-term tenants in place to streamline the process.

6. Analyze Potential Properties

- Perform a rental analysis: Calculate the potential rental income, operating costs (taxes, insurance, maintenance), and mortgage payments. A common benchmark is the 1% rule, which suggests that monthly rent should be at least 1% of the purchase price.

- Consider property management: If you won’t be managing the property yourself, research local property management companies and account for their fees (usually 8-12% of rental income).

- Perform inspections: A professional inspection can identify any necessary repairs that may affect your bottom line.

7. Make an Offer

- Negotiate price and terms: Work with firms like our firm KnockTheDoor.com or your agent to make a competitive offer. Be sure to negotiate based on comparable sales, property conditions, and market trends.

- Prepare for closing: If your offer is accepted, you’ll go through the closing process, which includes finalizing your financing, completing property inspections, and signing legal documents.

8. Prepare for Tenants

- Set competitive rent: Use your rental analysis to set a fair and competitive rent that attracts good tenants.

- Screen tenants: Perform background and credit checks to ensure you find reliable tenants who will pay rent on time and care for the property.

- Draft a lease agreement: Make sure the lease covers important aspects like rent due date, penalties for late payments, maintenance responsibilities, and eviction processes.

9. Maintain the Property

- Consider property management: If you are busy, or buying remote rental property and won’t be managing the property yourself, research local property management companies and account for their fees (usually 8-12% of rental income).

- Stay on top of repairs: Keeping your property in good condition will help you retain tenants and avoid costly repairs down the road.

- Monitor cash flow: Track your income and expenses carefully. Consider using property management software to simplify rent collection and financial reporting.

10. Consider Long-term Plans

- Plan for additional properties: Once you get comfortable with your first rental property, you may want to scale your investments by acquiring additional properties.

- Refinance or leverage equity: Over time, you may be able to refinance or use the equity in your rental property to purchase another investment property.

Disclaimer/Disclosures:

The information provided on this website is for general informational and educational purposes only and must NOT be construed as legal, financial, investment or any other expert advice. Real estate investing involves many risks; any content, presentations, pages, blog posts must not be construed as expert advise, results vary based on many many factors and variables.

We make no representations or warranties about the accuracy or reliability of the information provided.

Always consult a licensed expert, real estate professional and/or financial advisor about your real estate and investment decisions.

View our Disclosures, Privacy Policy and Terms & Conditions.