Getting Pre-Approved for a mortgage is an essential step in the home-buying process, as it gives you a clearer understanding of how much you can afford and signals to sellers that you are a serious buyer. Here’s a step-by-step guide on how to get Pre-Approved for a mortgage:

1. Check Your Credit Score

- Why It Matters: Your credit score significantly impacts your mortgage options and interest rates. Generally, a higher score can lead to better terms.

- Action: Obtain your credit report from one of the three major credit bureaus (Equifax, Experian, TransUnion) and review your score. If your score is lower than expected, consider taking steps to improve it before applying.

2. Gather Financial Documents

- What You’ll Need: Lenders typically require a variety of financial documents for Pre-Approval, including:

- Recent pay stubs (usually the last 2-3 months)

- Bank statements (checking and savings accounts, usually for the last 2-3 months)

- Tax returns (typically the last two years)

- W-2 forms (from the last two years)

- Documentation of any additional income (like bonuses or rental income)

- Proof of any assets (such as retirement accounts)

- Tip: Having these documents ready can expedite the Pre-Approval process.

3. Choose a Lender

- Options: You can work with various types of lenders, including:

- Traditional banks

- Credit unions

- Mortgage brokers

- Online lenders

- Action: Research lenders and compare their rates, fees, and customer service reviews to find one that fits your needs.

4. Complete the Application

- What to Expect: Most lenders will offer an online application process. You’ll need to provide:

- Personal information (name, address, Social Security number)

- Employment history (including job titles and length of employment)

- Financial information (monthly income, existing debts, assets)

- Tip: Be honest and thorough to avoid delays later in the process.

5. Submit to a Credit Check

- Why It’s Necessary: Lenders will perform a hard inquiry on your credit report to assess your creditworthiness.

- Impact on Credit: While a hard inquiry may slightly lower your credit score, the impact is usually minimal and temporary.

6. Receive Your Pre-Approval Letter

- What It Contains: Once your application is reviewed and approved, the lender will issue a Pre-Approval letter detailing:

- The loan amount you’re Pre-Approved for

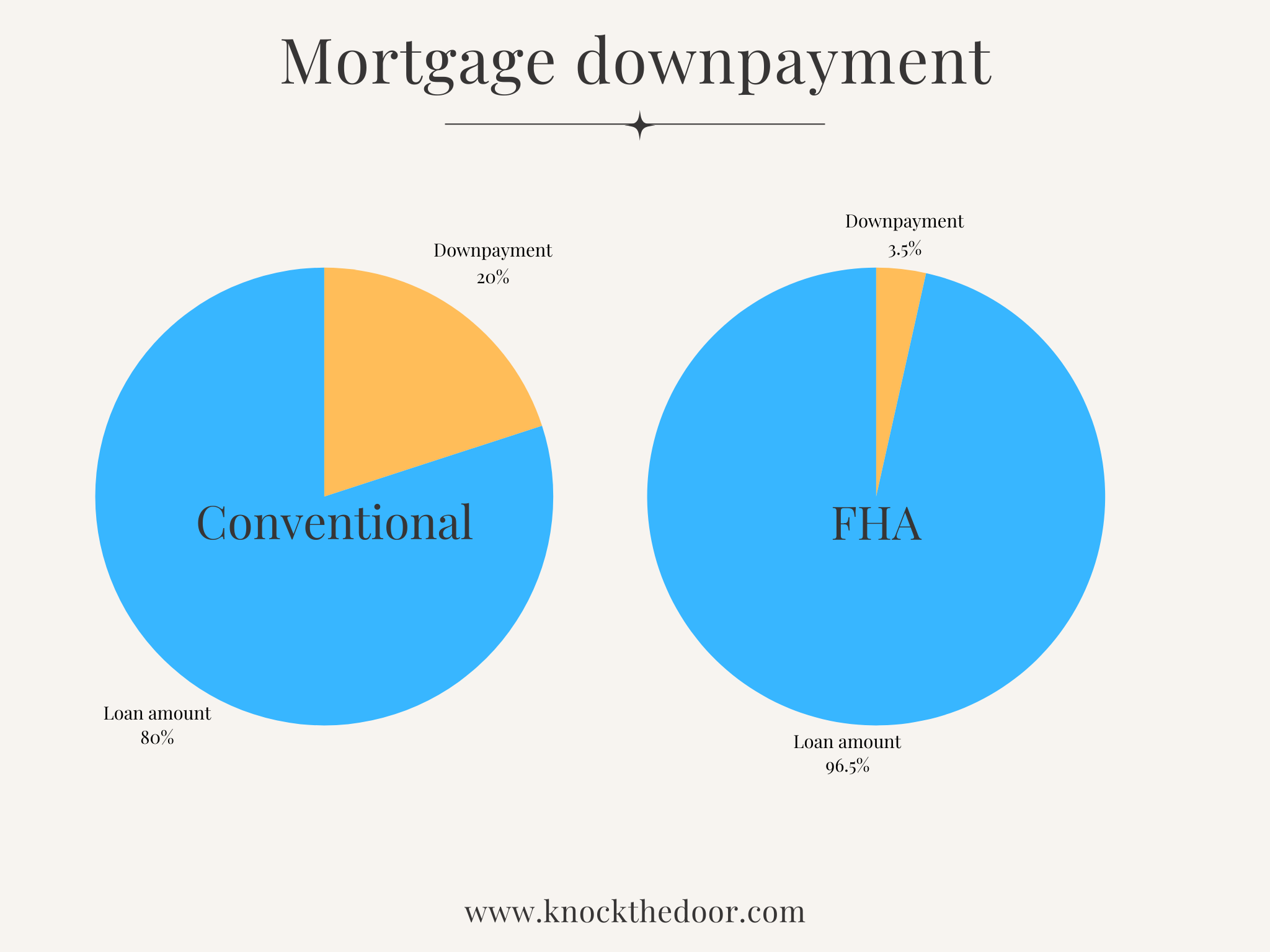

- The loan type (conventional, FHA, VA, etc.)

- The estimated interest rate (may be subject to change)

- Conditions that must be met for final approval

- Validity: A Pre-Approval letter typically lasts for 60-90 days, depending on the lender.

7. Understand the Terms and Conditions

- Review Carefully: Take the time to understand the terms outlined in the Pre-Approval letter. Ask your lender any questions you have regarding interest rates, fees, or loan conditions.

8. Shop for a Home

- With Confidence: With your Pre-Approval letter in hand, you can confidently shop for a home within your price range. Sellers will see you as a serious buyer, making your offers more competitive.

9. Stay in Communication with Your Lender

- Keep Them Updated: If your financial situation changes (like a job change or increase in debt), inform your lender. Any changes could affect your final loan approval.

10. Finalize Your Mortgage Application

- After Finding a Home: Once you find a property you wish to purchase, you’ll complete the mortgage application with your lender to finalize the loan details. The lender will conduct further checks and appraisals before issuing final approval.

Additional Tips

- Get Pre-Approved Early: Start the Pre-Approval process before house hunting to know your budget and streamline your search.

- Consider Multiple Lenders: Don’t hesitate to apply with more than one lender to compare offers and find the best terms.

- Watch Your Spending: Avoid large purchases or new debts after getting Pre-Approved, as these can affect your credit profile and debt-to-income ratio.

Conclusion

Getting Pre-Approved for a mortgage is a crucial step in the home-buying process that requires preparation and understanding. By checking your credit, gathering documents, and communicating with lenders, you can secure Pre-Approval and enhance your buying power in a competitive market.

Make sure that you agree to our Disclosures, Privacy and Terms.