Getting prequalified for a mortgage is a relatively straightforward process that helps you understand your borrowing capacity before you start house hunting. Here’s a step-by-step guide on how to get prequalified:

1. Gather Financial Information

- Documents to Prepare: Before starting the Pre-Qualification process, gather relevant financial documents, including:

- Recent pay stubs (typically the last 2-3 months)

- W-2 forms (for the past two years)

- Bank statements (checking and savings accounts, usually for the last 2-3 months)

- Information on any debts (credit cards, car loans, student loans)

- Details about your assets (retirement accounts, investments)

2. Choose a Lender

- Types of Lenders: You can apply for Pre-Qualification through various types of lenders, including:

- Traditional banks

- Credit unions

- Mortgage brokers

- Online lenders

- Research Options: Compare lenders based on interest rates, fees, and customer service reviews to find one that fits your needs.

💡

hey, Hola..bōⁿ-zhür..Ciao..Hallo..Nǐhǎo..S̄wạs̄dī..Jambo..Bonjou..こんにちは..xin chào..안녕하세요..geia..مرحبا!.

💡

Explore our KnockTheDoor.com Home Buyers Service

3. Complete the Pre-Qualification Application

- Application Process: Most lenders offer an online application process. During the application, you’ll need to provide:

- Personal information (name, address, Social Security number)

- Employment details (job title, length of employment)

- Financial information (monthly income, existing debts, assets)

- Tip: Be thorough and honest in your responses to ensure an accurate assessment.

4. Discuss Your Financial Situation

- Communication: Depending on the lender, you may have a conversation with a loan officer who will ask about your financial situation, including:

- Your income

- Monthly expenses

- Any additional sources of income

- Get Guidance: This is a good opportunity to ask questions about the mortgage process and gain insights into your options.

5. Receive Your Pre-Qualification Estimate

- What It Includes: After reviewing your information, the lender will provide an estimate of how much you can borrow, often referred to as a Pre-Qualification letter. This letter may include:

- Estimated loan amount

- Interest rate range

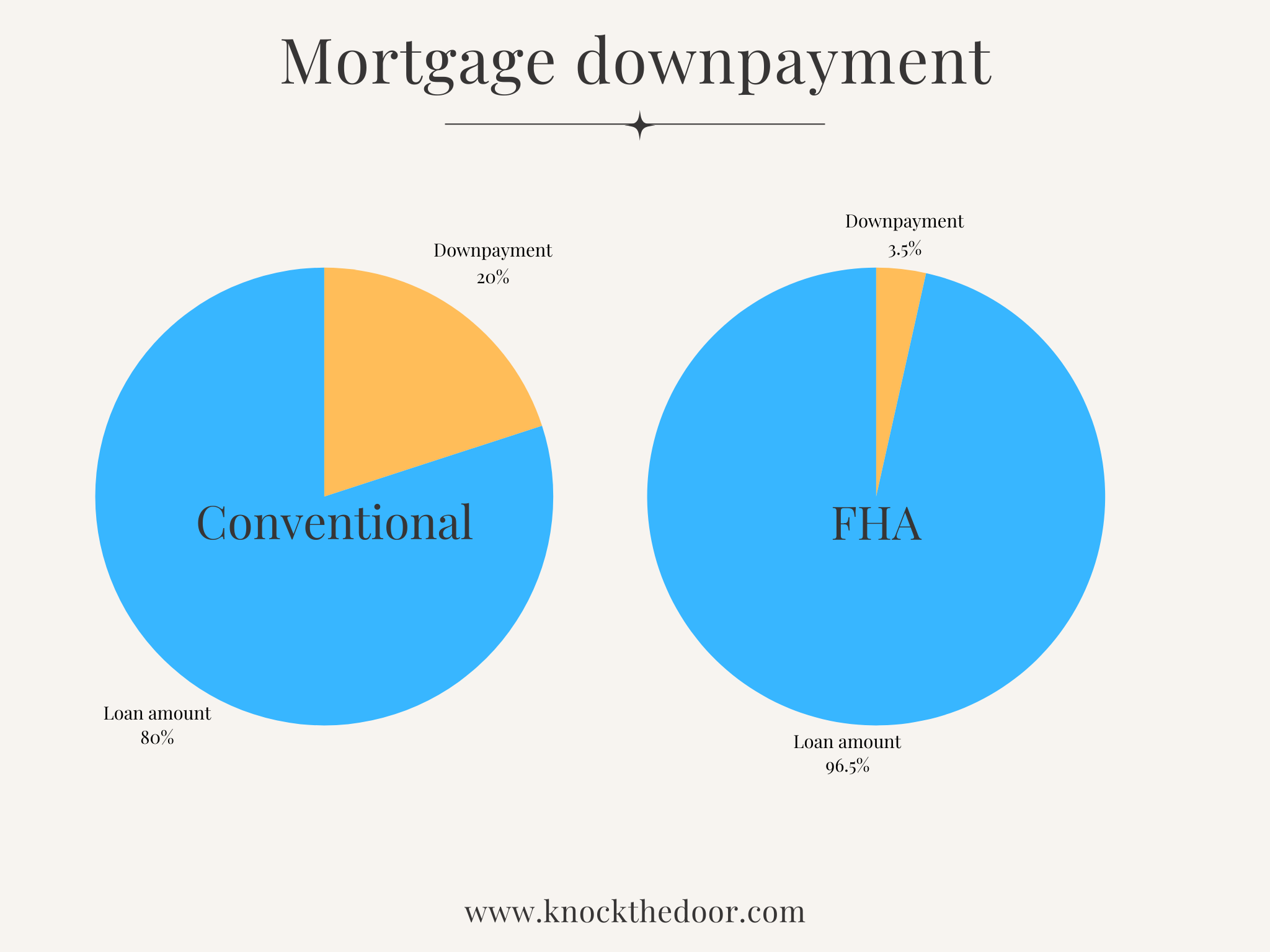

- Overview of the loan types you may qualify for

- Note: A Pre-Qualification letter is typically based on the information you provided and does not involve a credit check.

6. Understand the Limitations

- Know Its Nature: A Pre-Qualification letter is not a guarantee of a loan. It is an estimate based on your financial situation at the time of application. For a stronger commitment, you may want to pursue preapproval later.

7. Shop for Homes

- With Confidence: Use your Pre-Qualification letter to start shopping for homes within your price range. Knowing your estimated borrowing capacity will help you narrow down your search.

8. Revisit Your Pre-Qualification if Needed

- Update as Necessary: If your financial situation changes (new job, increased income, or changes in debts), consider revisiting the Pre-Qualification process to obtain an updated estimate.

Conclusion

Getting prequalified for a mortgage is an important first step in the home-buying process. By gathering your financial information, choosing a lender, and completing the application, you can gain valuable insights into your borrowing capacity, making your home search more focused and informed.

Make sure that you read our Disclosures, Privacy and Terms.