Coming up with a down payment for a rental property can be challenging, especially if you’re trying to minimize upfront costs. Here are some clever strategies to consider for generating the necessary funds:

1. Save Aggressively

- Automate Savings: Set up automatic transfers to a dedicated savings account specifically for your down payment. Treat it like a bill to ensure consistency.

- Cut Unnecessary Expenses: Review your budget for areas to cut back, such as dining out, subscriptions, or luxury items. Redirect these funds toward your down payment savings.

2. Leverage Your Home Equity

- Home Equity Loan or Line of Credit (HELOC): If you own a home, consider tapping into your home equity through a loan or a HELOC. This allows you to use your existing home value to fund the down payment on your rental property.

- Cash-Out Refinance: Refinance your existing mortgage for a higher amount and take the difference in cash to use for your down payment.

3. Gift Funds from Family or Friends

- Gift Money: Ask family members or close friends if they would be willing to gift you part of the down payment. Many lenders allow a certain percentage of the down payment to come from gifts.

- Formalize the Gift: Make sure to document the gift properly to avoid any tax implications or issues with your lender.

4. Find a Partner or Investor

- Co-Investor: Partner with someone who can contribute to the down payment in exchange for a share of the profits. This can be a friend, family member, or even a business associate.

- Real Estate Syndication: Join or create a real estate syndicate where multiple investors pool their resources to purchase properties. You can contribute a smaller amount toward the down payment.

5. Consider Alternative Financing Options

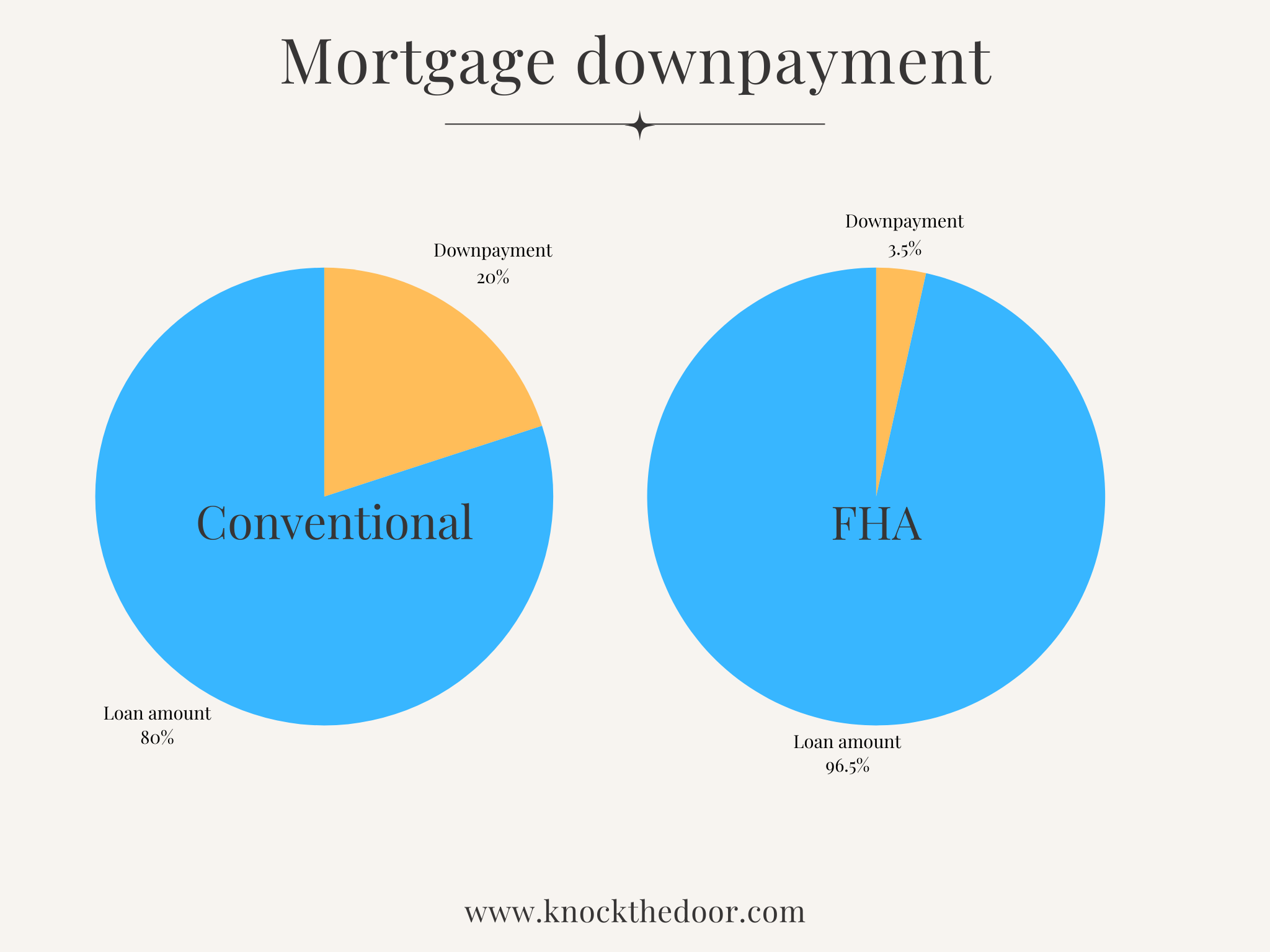

- FHA Loans: Explore FHA loans, which allow for down payments as low as 3.5% for owner-occupied multi-family properties. You must live in one unit, but it can be a way to enter the rental market.

- VA Loans: If you’re a veteran, consider using a VA loan, which offers no down payment options for eligible borrowers purchasing a multi-family property as their primary residence.

6. Utilize Retirement Accounts

- Self-Directed IRA: If you have a self-directed IRA, you can invest in real estate directly through this account. However, be cautious about withdrawal penalties if you’re using other retirement accounts.

- Borrow from Your 401(k): Some employer-sponsored 401(k) plans allow you to borrow against your balance. Check with your plan administrator for specifics, as this can provide immediate cash for a down payment.

7. Sell Unused Items

- Garage Sale: Declutter your home and sell items you no longer use or need. Use the proceeds to contribute to your down payment savings.

- Online Selling: Use platforms like eBay, Facebook Marketplace, or Craigslist to sell unwanted items, generating quick cash.

8. Take on Side Gigs or Freelancing

- Part-Time Job: Consider taking a part-time job or side gig to boost your income specifically for your down payment.

- Freelancing: Utilize skills you have to take on freelance work. Platforms like Upwork or Fiverr can help you find opportunities.

9. Apply for Down Payment Assistance Programs

- Local and State Programs: Research down payment assistance programs offered by local or state governments, non-profits, or community organizations. These programs often provide grants or low-interest loans to help first-time buyers.

- Employer Assistance Programs: Some employers offer down payment assistance as part of their benefits package. Check with your HR department for any available programs.

10. Invest in Real Estate Wholesaling

- Wholesaling: Consider entering the real estate wholesaling market, where you find and contract properties to sell to investors at a higher price. The profits can be used as a down payment on your own rental property.

11. Utilize a 1031 Exchange

- Real Estate Investment: If you already own investment properties, consider a 1031 exchange to defer capital gains taxes and reinvest the proceeds into a new rental property. This can allow you to leverage your current investments for a down payment.

Conclusion

Finding a down payment for a rental property may seem time consuming unless you have savings, but with creativity and resourcefulness, you can explore various options to gather the necessary funds. Each strategy has its advantages and considerations, so it’s important to choose the ones that align with your financial situation and long-term investment goals. Always consult with a financial advisor or real estate professional to ensure you’re making informed decisions.

Disclaimer/Disclosures:

The information provided on this website is for general informational and educational purposes only and must NOT be construed as legal, financial, investment or any other expert advice. Real estate investing involves many risks; any content, presentations, pages, blog posts must not be construed as expert advise, results vary based on many many factors and variables.

We make no representations or warranties about the accuracy or reliability of the information provided.

Always consult a licensed expert, real estate professional and/or financial advisor about your real estate and investment decisions.

View our Disclosures, Privacy Policy and Terms & Conditions