Credit requirements for securing a mortgage loan vary based on loan type, lender policies, and borrower financial profiles. Lenders consider credit score, credit history, and debt-to-income (DTI) ratio to determine loan eligibility, interest rates, and loan terms. Here’s an overview of the typical credit requirements for different types of mortgage loans:

1. Credit Score Requirements

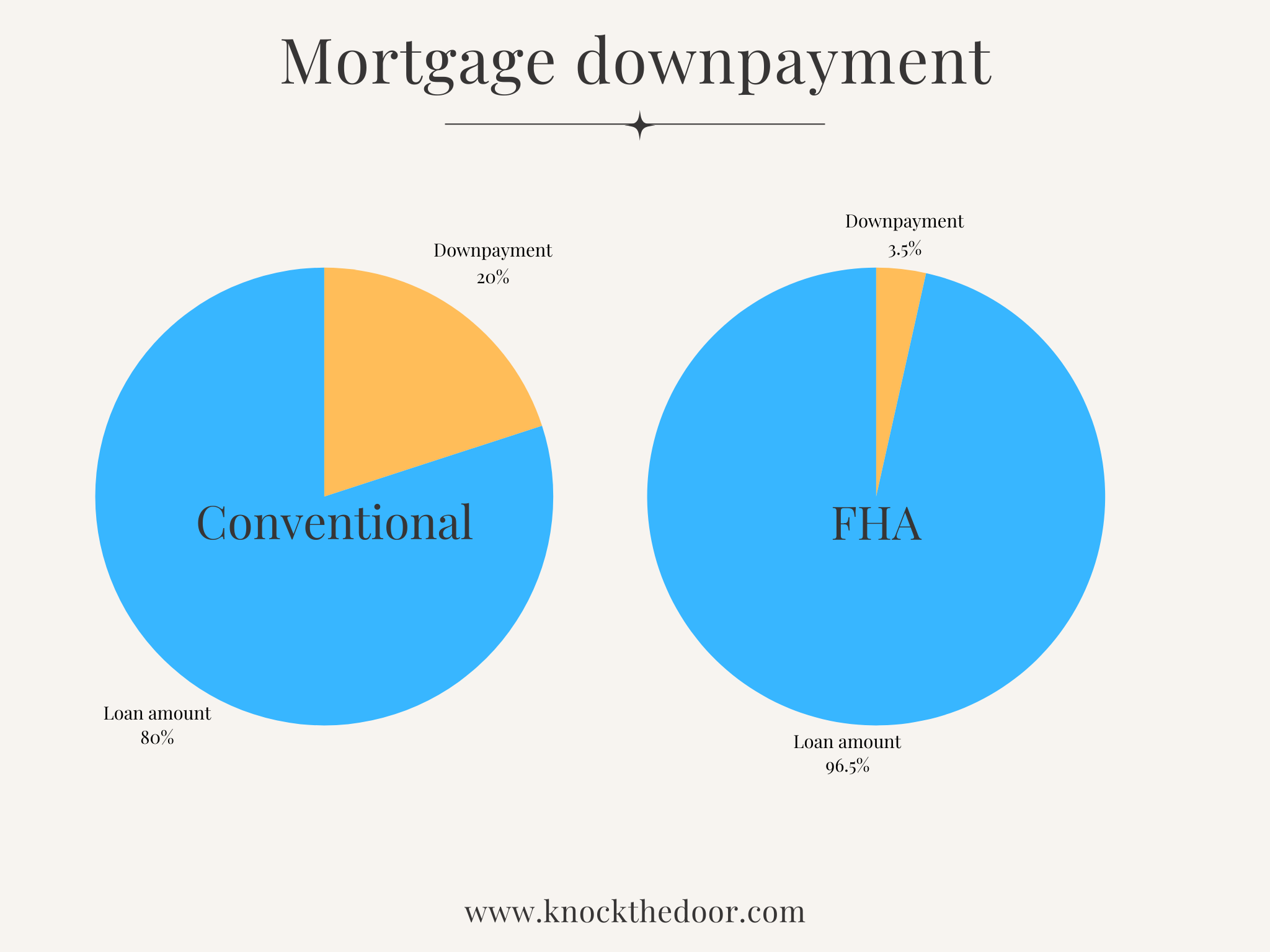

- Conventional Loans:

- Minimum credit score: 620.

- Borrowers with scores of 700+ typically qualify for better interest rates and terms.

- For conventional loans with less than 20% down, lenders may require a higher score to offset PMI costs.

- FHA Loans:

- Minimum credit score: 580 for a 3.5% down payment.

- Borrowers with scores between 500-579 may qualify with a 10% down payment, though lenders may be selective.

- FHA is often more lenient with credit scores but may come with higher costs in mortgage insurance.

- VA Loans:

- No official minimum credit score set by the VA, but most lenders require at least 620.

- Higher scores may qualify for better rates, though VA loans are typically more flexible in credit requirements.

- USDA Loans:

- Minimum credit score: 640 to qualify for USDA’s automated underwriting; lower scores may still qualify with manual underwriting.

- USDA is designed for low- to moderate-income borrowers, so flexibility may apply depending on income and property location.

- Jumbo Loans (Non-Conforming):

- Minimum credit score: 700+, with some lenders requiring as high as 720.

- Higher scores are usually required due to the larger loan amounts and greater risk to lenders.

2. Credit History and Payment Behavior

- On-Time Payment History: Lenders look closely at a borrower’s payment history, especially for housing-related payments like previous mortgages or rent. Consistent on-time payments over the past 12-24 months indicate reliability.

- Derogatory Marks: Late payments, collections, charge-offs, foreclosures, and bankruptcies are viewed as risk factors. While some loan types (like FHA) are more forgiving, lenders typically require borrowers to wait after significant credit events:

- Foreclosure: Generally, a 7-year waiting period for conventional loans; 3 years for FHA loans.

- Bankruptcy: 4 years for conventional loans (Chapter 7), 2 years for FHA loans (Chapter 7), and 2 years for VA loans.

3. Debt-to-Income (DTI) Ratio Requirements

- Definition: DTI ratio measures monthly debt obligations against gross monthly income. A lower DTI ratio suggests more disposable income and a lower risk of default.

- Standard DTI Limits by Loan Type:

- Conventional Loans: Typically require a DTI below 45%, though borrowers with high credit scores and larger down payments may qualify with slightly higher DTIs.

- FHA Loans: Accept DTIs up to 50% with compensating factors, like a higher down payment or good credit history.

- VA Loans: No strict DTI limits, though most lenders prefer DTI below 41%; exceptions may be made based on residual income and other factors.

- USDA Loans: Often require a DTI below 41%, though allowances may be made based on compensating factors.

4. Loan Type and Down Payment as Compensating Factors

- Higher Down Payment: A larger down payment can sometimes offset a lower credit score or higher DTI, especially for conventional and jumbo loans. For FHA loans, a higher down payment (10%) may allow borrowers with scores as low as 500.

- Cash Reserves: Demonstrating cash reserves can make borrowers more attractive to lenders, as it indicates financial stability.

Summary of Credit Requirements by Loan Type

Tips for Meeting Credit Requirements

- Improve Credit Score Before Applying: Pay down outstanding balances, avoid new credit inquiries, and correct errors on your credit report to increase your score.

- Reduce Debt-to-Income Ratio: Pay down existing debt and limit new debt to improve your DTI ratio.

- Save for a Larger Down Payment: A higher down payment can help reduce loan risk and potentially lower PMI and interest rates.

- Consider Co-Borrowers: A co-borrower with a stronger credit profile can improve eligibility for some loans and reduce risk factors.

By understanding these requirements, you can choose the right loan type and take steps to meet the criteria for favorable loan terms. Working with a mortgage lender can also help clarify specific requirements for your situation and loan type.

Disclaimer/Disclosures:

The information provided on this website is for general informational and educational purposes only and must NOT be construed as legal, financial, investment or any other expert advice. Real estate investing involves many risks; any content, presentations, pages, blog posts must not be construed as expert advise, results vary based on many many factors and variables.

We make no representations or warranties about the accuracy or reliability of the information provided.

Always consult a licensed expert, real estate professional and/or financial advisor about your real estate and investment decisions.

View our Disclosures, Privacy Policy and Terms & Conditions.