When you decide to buy real estate rental property, you have several options depending on the type of property, your financial goals, and how involved you want to be in managing the property. Here are the main options:

1. Property Types

Choosing the right type of property is key to aligning with your investment strategy and risk tolerance.

A. Single-Family Homes

- Description: Stand-alone homes rented out to individuals or families.

- Pros:

- Easier to manage with only one tenant.

- Typically less expensive than multi-family properties.

- Easier to sell, offering more liquidity.

- Cons:

- Only one income stream, which makes vacancy risk higher.

B. Multi-Family Homes (Duplex, Triplex, Fourplex)

- Description: Properties with 2-4 rental units.

- Pros:

- Multiple rental income streams from one property.

- Potential to live in one unit while renting out the others (house hacking).

- Qualifies for residential financing.

- Cons:

- Higher management and maintenance responsibilities.

- Can be more expensive than single-family homes.

C. Apartment Buildings (5+ Units)

- Description: Larger properties with five or more rental units.

- Pros:

- High cash flow potential due to multiple tenants.

- Economies of scale for management and maintenance.

- Cons:

- Requires commercial financing (more stringent terms).

- Higher initial cost and complexity in managing multiple units.

D. Short-Term Rental Properties (Airbnb, VRBO)

- Description: Properties rented out on a short-term basis, typically to tourists or business travelers.

- Pros:

- Potentially higher income than long-term rentals.

- Flexibility to use the property yourself when it's not rented.

- Cons:

- More active management required (cleaning, guest communication).

- Subject to local regulations and zoning laws.

E. Vacation Homes

- Description: Properties located in vacation destinations, rented out seasonally.

- Pros:

- Personal use of the property when it's not rented.

- Potentially high rental income during peak seasons.

- Cons:

- Rental income may be seasonal.

- Higher vacancy rates during off-seasons.

F. Commercial Properties

- Description: Office buildings, retail spaces, or industrial properties rented to businesses.

- Pros:

- Long-term leases provide stable rental income.

- Businesses are often responsible for property maintenance (triple-net leases).

- Cons:

- Higher upfront cost and more complex financing.

- Vulnerability to economic downturns (business closures).

2. Financing Options

Your financing options can significantly affect the cost and profitability of your investment.

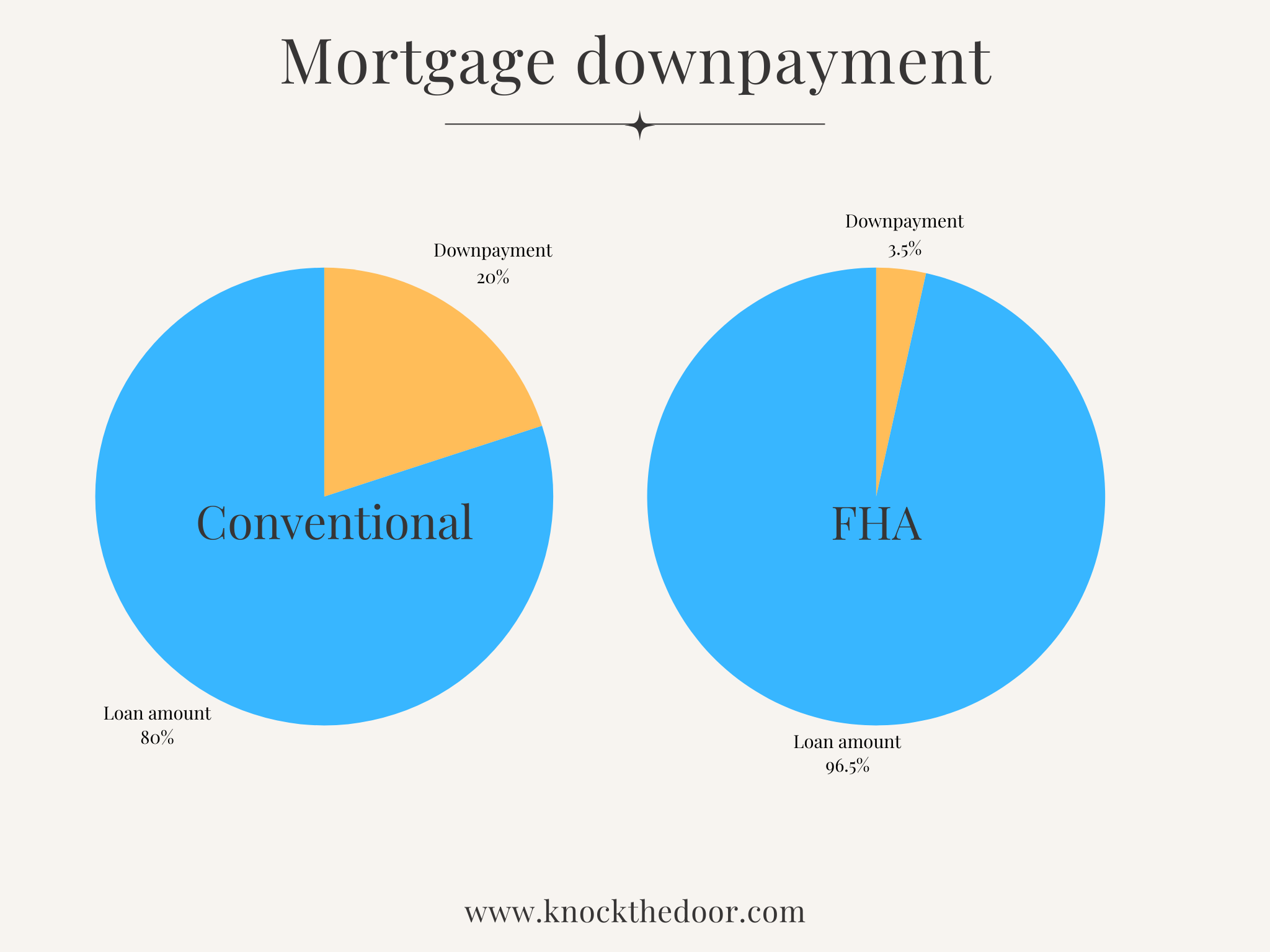

A. Conventional Mortgage

- Description: Traditional mortgage financing for single-family or multi-family homes.

- Pros:

- Low-interest rates and predictable payment structure.

- Available for 1-4 unit properties.

- Cons:

- Requires a larger down payment (15-25% for investment properties).

- Must meet strict credit and income requirements.

B. FHA or VA Loans (For House Hacking)

- Description: Loans designed for owner-occupied properties, allowing you to purchase multi-family properties with low down payments.

- Pros:

- FHA loans require as little as 3.5% down.

- VA loans offer no down payment options for veterans.

- Cons:

- You must live in one of the units for at least a year.

- Limited to 2-4 unit properties.

C. Hard Money Loans

- Description: Short-term, high-interest loans used by investors for property purchases, especially fix-and-flip projects.

- Pros:

- Fast approval and access to capital.

- Useful for distressed properties or quick deals.

- Cons:

- Higher interest rates and fees.

- Shorter repayment periods, typically 6-12 months.

D. Seller Financing

- Description: The seller acts as the lender, allowing you to make payments directly to them.

- Pros:

- More flexible terms than conventional financing.

- Can be used when you don’t qualify for a traditional mortgage.

- Cons:

- Sellers may charge higher interest rates.

- Limited availability, as not all sellers are willing to finance.

E. Portfolio Loans

- Description: Loans designed for investors with multiple properties, allowing you to finance several properties under one loan.

- Pros:

- Simplifies financing and management of multiple properties.

- Tailored for experienced investors.

- Cons:

- Requires a strong financial profile and track record.

- Higher down payments and stricter loan terms.

F. Crowdfunding and Real Estate Syndication

- Description: Pooling resources with other investors to purchase large properties or development projects.

- Pros:

- Access to larger real estate deals with smaller capital investments.

- No need to actively manage the property.

- Cons:

- Less control over the property.

- Subject to platform fees and risks of the deal not performing as expected.

3. Investment Strategies

How you choose to manage and grow your real estate investment depends on your goals and resources.

A. Buy and Hold

- Description: Purchase a property and rent it out for the long term, aiming to generate steady income and benefit from property appreciation.

- Pros:

- Passive income from rent.

- Long-term appreciation potential.

- Cons:

- Requires property management (or hiring a manager).

- Long-term commitment.

B. House Hacking

- Description: Live in one part of the property (e.g., one unit of a multi-family property) and rent out the other units to cover your mortgage.

- Pros:

- Reduces your housing costs while building equity.

- Potentially lower down payment with FHA or VA loans.

- Cons:

- Requires you to live on the property.

- Limited to smaller multi-family properties (2-4 units).

C. BRRRR (Buy, Rehab, Rent, Refinance, Repeat)

- Description: A strategy where you buy distressed properties, rehab them, rent them out, refinance to pull out equity, and repeat the process.

- Pros:

- Maximizes cash flow by refinancing and pulling out capital.

- Adds value through renovations, increasing rental income and property value.

- Cons:

- Requires capital and experience with renovation projects.

- Timing is crucial for refinancing.

D. Fix and Flip

- Description: Buy properties at a discount, renovate them, and sell them for a profit.

- Pros:

- Potential for quick, high profits.

- No long-term commitment to property management.

- Cons:

- High-risk strategy dependent on market conditions.

- Requires expertise in property renovation and local real estate markets.

E. Short-Term Rental Arbitrage

- Description: Rent a property long-term from a landlord, then sublease it as a short-term rental (e.g., on Airbnb or VRBO).

- Pros:

- You don’t have to own the property, so less capital is required.

- Potential for high income in popular tourist or business areas.

- Cons:

- Needs permission from the property owner.

- Subject to local laws regulating short-term rentals.

F. Real Estate Investment Trusts (REITs)

- Description: Investing in a REIT allows you to own shares of real estate portfolios without buying or managing the properties yourself.

- Pros:

- Liquidity and diversification.

- Passive income from dividends.

- Cons:

- No direct control over property management.

- Returns can be influenced by market trends.

4. Management Options

Deciding how to manage your rental property is crucial to maintaining profitability and minimizing headaches.

A. Self-Management

- Pros:

- Saves on property management fees.

- Full control over tenant selection, repairs, and property upkeep.

- Cons:

- Time-consuming, especially with multiple properties.

- Requires knowledge of landlord-tenant laws and property maintenance.

B. Hire a Property Manager

- Pros:

- Professional management of tenant screening, rent collection, and maintenance.

- Less involvement for you, especially if you have multiple properties.

- Cons:

- Property management fees (usually 8-12% of rental income).

- Less direct control over how the property is managed.

Disclaimer/Disclosures:

The information provided on this website is for general informational and educational purposes only and must NOT be construed as legal, financial, investment or any other expert advice. Real estate investing involves many risks; any content, presentations, pages, blog posts must not be construed as expert advise, results vary based on many many factors and variables.

We make no representations or warranties about the accuracy or reliability of the information provided.

Always consult a licensed expert, real estate professional and/or financial advisor about your real estate and investment decisions.

View our Disclosures, Privacy Policy and Terms & Conditions.