The Loan Status Update (LSU) is a key document used in real estate transactions, particularly in states like Arizona, to track and communicate the progress of a buyer's loan application. It is a standardized form that keeps all parties informed about the loan's status and ensures transparency between buyers, sellers, and their respective agents.

Key Features of the Loan Status Update (LSU)

1. Purpose

- To provide updates on the buyer's mortgage process and loan approval status.

- To ensure the seller is aware of the buyer's ability to secure financing and meet agreed-upon deadlines.

2. Who Prepares It?

- The buyer’s lender or mortgage broker typically completes the LSU.

- It is then submitted by the buyer’s agent to the seller’s agent and/or directly to the seller.

3. When Is It Used?

- Initial Submission:

- Typically completed and submitted with the purchase contract or shortly after.

- Demonstrates the buyer’s financial readiness.

- Ongoing Updates:

- Updated throughout the escrow process as loan milestones are reached.

4. What Information Does It Include?

The LSU is divided into sections that cover critical aspects of the loan process, including:

- Buyer’s Loan Information:

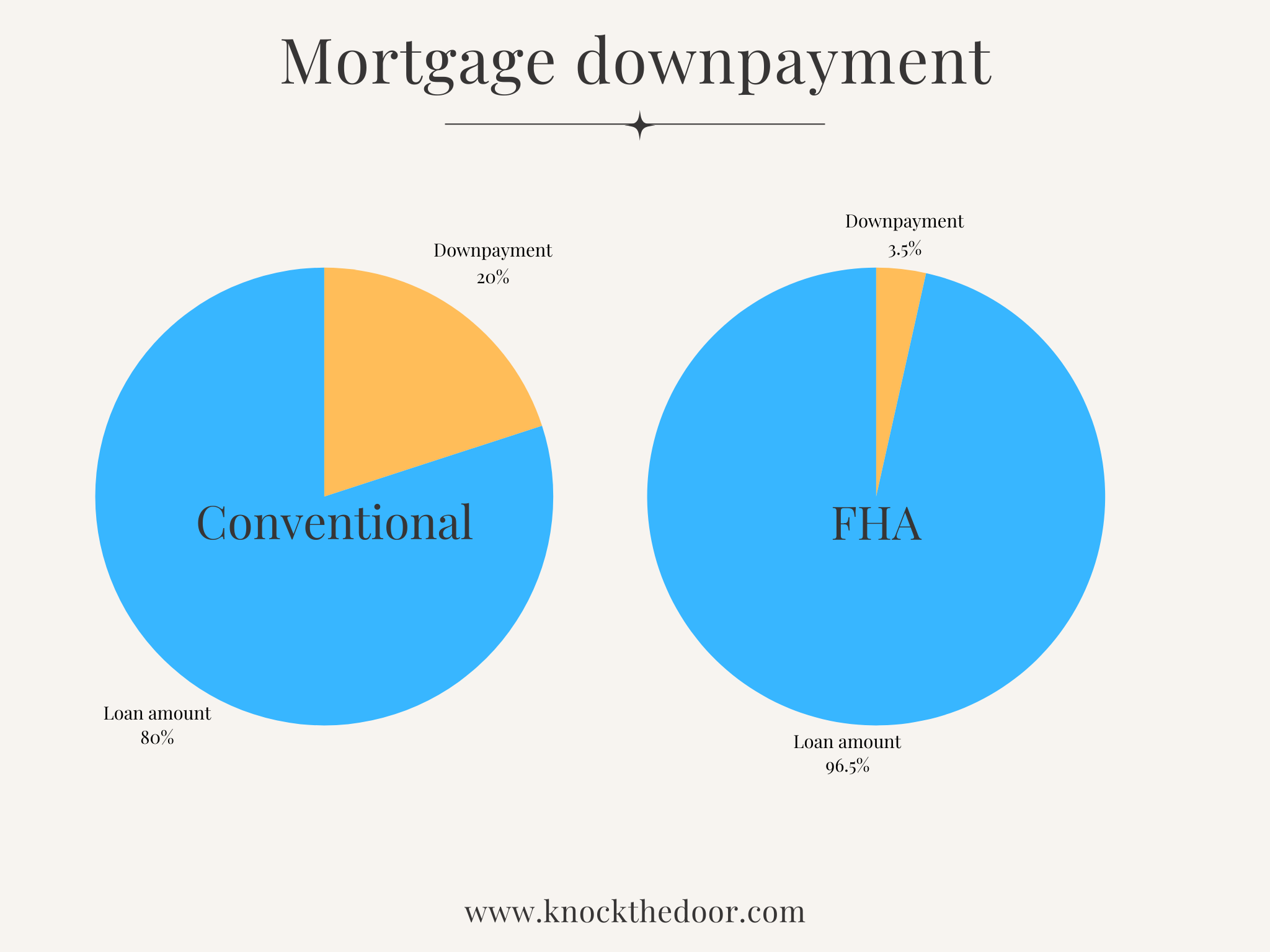

- Type of loan (e.g., FHA, VA, conventional).

- Loan amount and down payment percentage.

- Loan Application Status:

- Confirms whether the buyer has completed the loan application.

- Credit Check:

- Indicates whether the lender has reviewed the buyer's credit report.

- Verification of Income and Assets:

- Confirms whether the lender has verified the buyer’s income and assets.

- Appraisal:

- Status of the appraisal, such as whether it has been ordered, completed, or approved.

- Underwriting Approval:

- Whether the buyer has received conditional or final underwriting approval.

- Loan Closing Timeline:

- Estimated date for final loan approval and closing.

- Additional Information:

- Notes about any outstanding conditions or issues.

5. Benefits of the LSU

- For Sellers:

- Provides confidence that the buyer is progressing toward securing financing.

- Allows sellers to address potential delays early in the process.

- For Buyers:

- Keeps the buyer accountable for meeting deadlines.

- Ensures the buyer is proactive about completing loan-related tasks.

- For Agents:

- Facilitates communication between all parties.

- Helps agents manage transaction timelines effectively.

6. Legal and Contractual Importance

- The LSU may be required as part of the real estate purchase contract.

- Failing to provide or update the LSU in a timely manner could result in breaches of the contract or delays in closing.

Best Practices for Handling the LSU

- Timely Updates:

- Ensure the LSU is updated at key milestones (e.g., after appraisal, underwriting approval).

- Open Communication:

- Keep all parties informed of any issues or delays reflected in the LSU.

- Accuracy:

- Verify that all information in the LSU is accurate and up-to-date.

Disclaimer/Disclosures:

The information provided on this website is for general informational and educational purposes only and must NOT be construed as legal, financial, investment or any other expert advice. Real estate investing involves many risks; any content, presentations, pages, blog posts must not be construed as expert advise, results vary based on many many factors and variables.

We make no representations or warranties about the accuracy or reliability of the information provided.

Always consult a licensed expert, real estate professional and/or financial advisor about your real estate and investment decisions.

View our Disclosures, Privacy Policy and Terms & Conditions.