The minimum down payment for an investment property depends on several factors, such as the type of property, the lender’s requirements, and the type of loan you’re using.

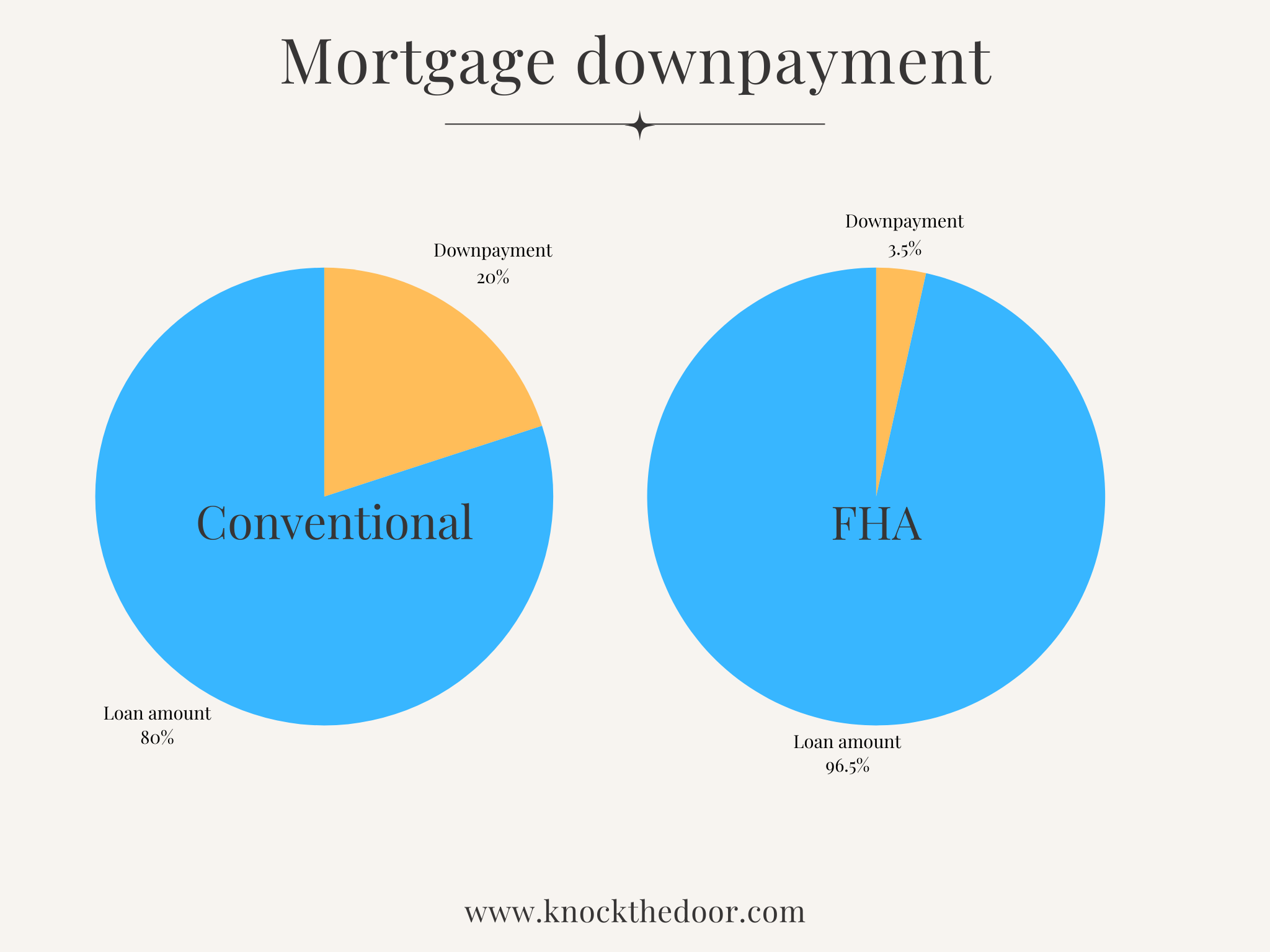

1. Conventional Loans

- Single-family home: For a single-family investment property (not owner-occupied), the typical minimum down payment is 15-20% of the purchase price.

- 15% down payment is generally the minimum for a single-family investment property. However, many lenders prefer or require a 20% down payment to offer better terms and avoid private mortgage insurance (PMI).

- Multi-family properties (2-4 units): Lenders often require a 25% down payment for small multi-family investment properties (duplex, triplex, or fourplex).

2. FHA Loans

- FHA loans are generally intended for primary residences, but you can use an FHA loan to purchase a multi-family property (up to 4 units), as long as you live in one of the units. In this case, you may qualify for a down payment as low as 3.5%. This approach is often called house hacking—living in one unit while renting out the others.

- Note: FHA loans cannot be used for purely investment purposes (where you don’t occupy the property).

3. VA Loans

- If you're a qualifying veteran, the VA loan allows you to purchase a multi-family property (up to 4 units) with no down payment as long as you occupy one of the units. This can be an excellent option for house hacking.

4. Hard Money Loans

- Hard money loans are used by investors who may not qualify for traditional financing or need quick access to capital. These loans typically have more flexible down payment requirements but usually require 20-30% down, with higher interest rates than conventional loans.

5. Portfolio Loans

- Some lenders offer portfolio loans, which are designed for real estate investors purchasing multiple properties. Down payments can vary widely, but typically, lenders expect 20-25% down for these types of loans.

6. Owner-Occupied Loans (House Hacking)

- If you plan to live in the property and rent out the remaining units, you might qualify for lower down payments:

- 3.5% down with FHA loans (for multi-family properties up to 4 units).

- 0% down with VA loans for veterans.

- In these cases, you can live in one unit and rent out the others, making it easier to afford an investment property with less upfront capital.

Summary of Typical Minimum Down Payments:

- 15-20% for a single-family investment property.

- 25% for multi-family investment properties (2-4 units) with conventional loans.

- 3.5% with an FHA loan for a multi-family property (if you live in one unit).

- 0% with a VA loan for a multi-family property (if you live in one unit and are a veteran).

- 20-30% for hard money loans.

The actual down payment required can vary depending on your lender, credit score, and the type of property you’re buying. Larger down payments may give you access to better mortgage terms and avoid the need for PMI.

Disclaimer/Disclosures:

The information provided on this website is for general informational and educational purposes only and must NOT be construed as legal, financial, investment or any other expert advice. Real estate investing involves many risks; any content, presentations, pages, blog posts must not be construed as expert advise, results vary based on many many factors and variables.

We make no representations or warranties about the accuracy or reliability of the information provided.

Always consult a licensed expert, real estate professional and/or financial advisor about your real estate and investment decisions.

View our Disclosures, Privacy Policy and Terms & Conditions.